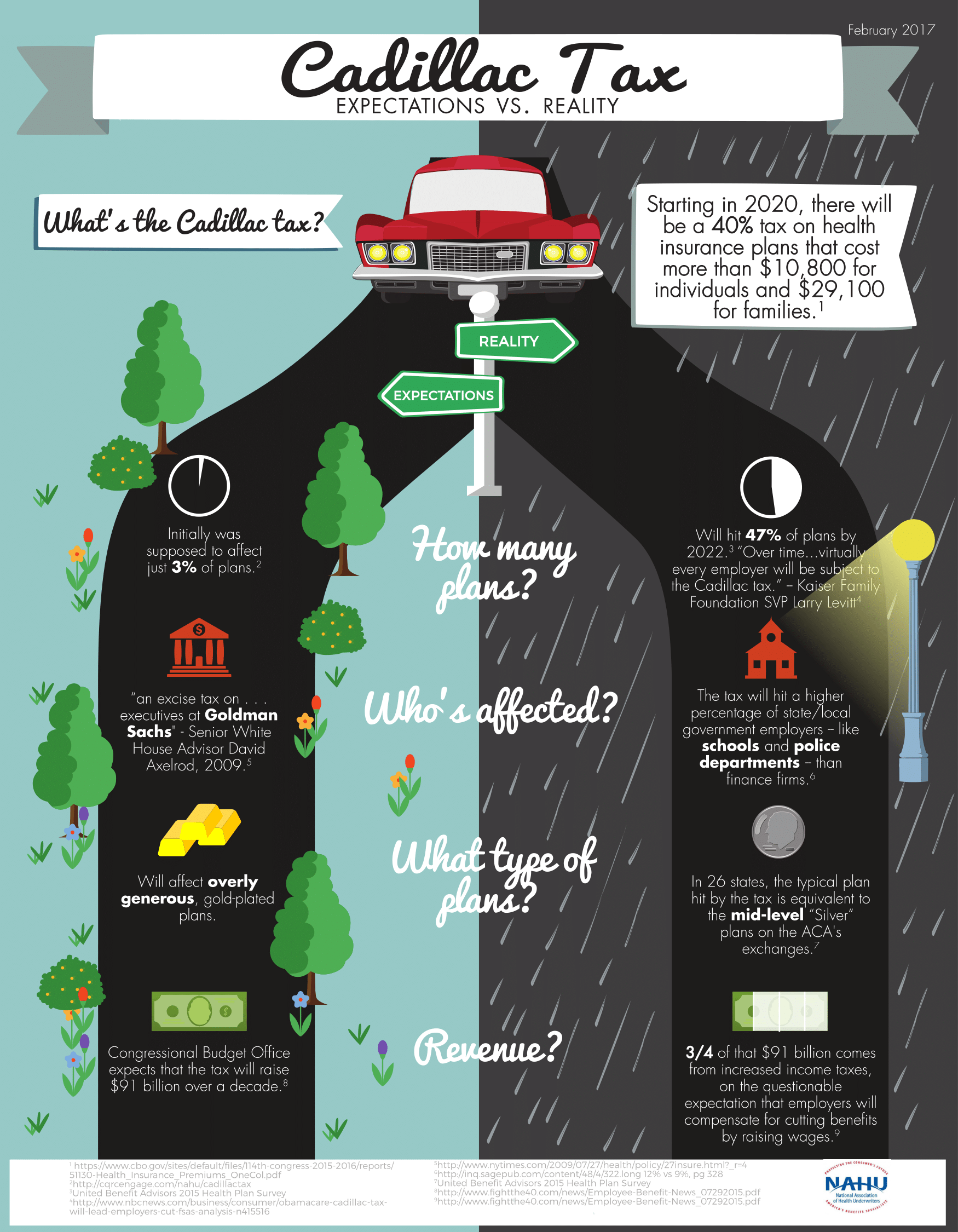

The Affordable Care Act (ACA) includes a high-cost plan tax (nicknamed the Cadillac Tax) on health plans with a premium of $10,200 or more annually for an individual and $27,500 or more annually for family coverage. The implementation has been pushed back twice, and one of the 2017 GOP proposals would further delay it until 2025. However, as it stands right now, the 40% excise tax levy will begin in 2020, with premium levels adjusted for inflation.

Back in 2010, proponents of the high-cost plan tax said it would affect only a small portion of health plans and employees. News accounts at the time talked about plans for Wall Street titans that had annual premiums of $40,000.

The rationale for establishing a tax was that those with Cadillac plans often had lower deductibles and coverage that included even the most expensive treatments, so members were going to the doctor more often and helping push medical costs even higher. By leveling a new tax on Cadillac plans, it was thought employers might move away from the high-cost plans and embrace a movement toward consumer-oriented health care, where the patient plays a more active role in his or her medical plan choices – ultimately helping reign in the escalating costs of medical care and health insurance premium costs for all consumers.

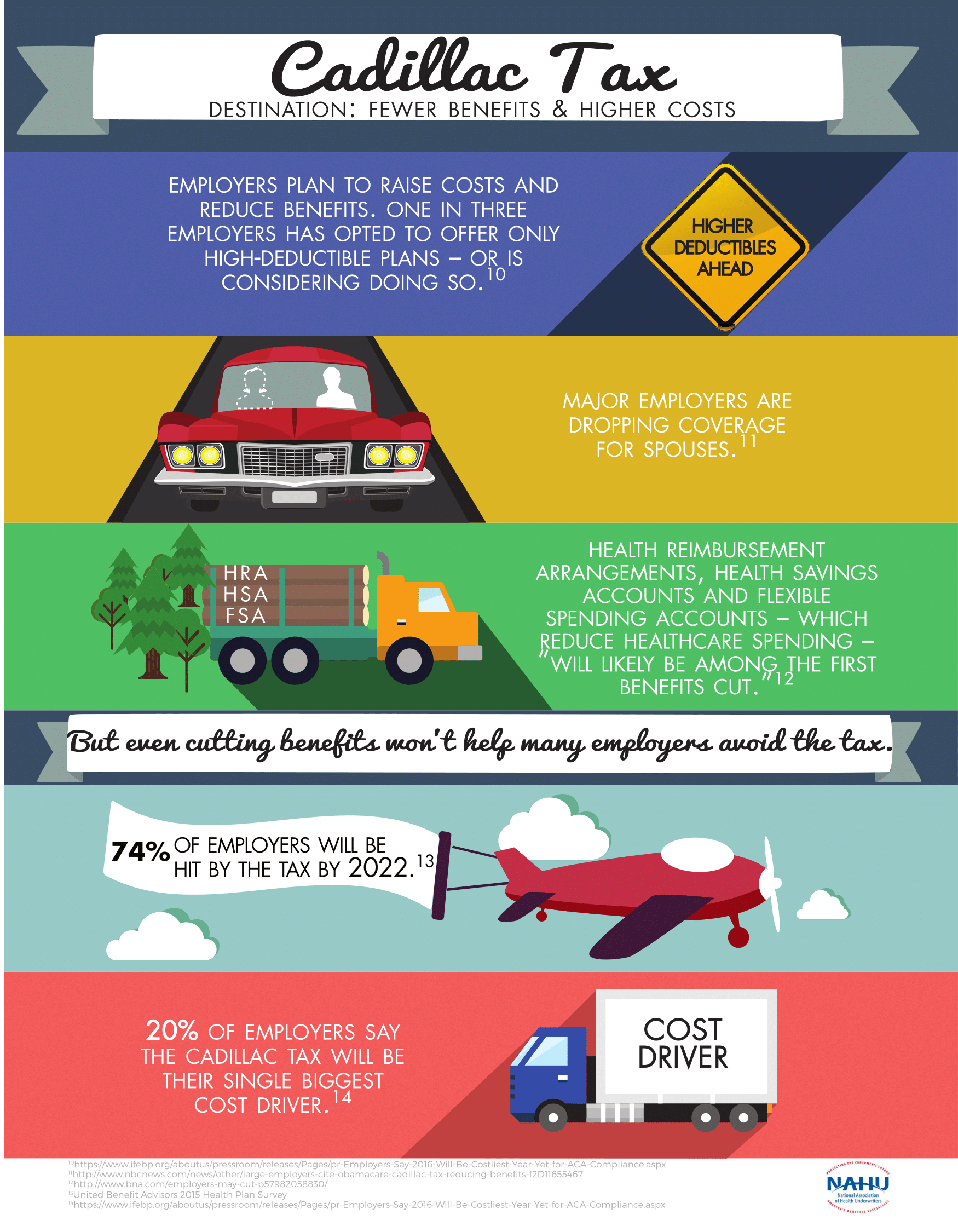

However, premium costs can be high for reasons other than generous benefits, such as the patient’s age, gender, and overall health status. As health insurance costs continue to climb, it appears more and more employers – and their employees – could be affected by the planned Cadillac Tax. Indeed, an August report by the National Business Group on Health is forecasting an average $14,156 premium per employee for large employers, with employees at smaller groups facing higher costs.

Join the fight against the Cadillac Tax by sharing this infographic from the National Association of Health Underwriters (NAHU) with your clients.