Insurance regulation is constantly evolving – at both the state and federal levels. It’s sometimes a challenge for businesses to stay on top of all of the rule and regulation changes. But failing to comply can lead to costly penalties. Word & Brown is committed to helping you stay up to date, so you can prove your ongoing value to your clients and ensure their continuous compliance.

Recently, Compliance Analyst Team Lead Rene Gonzalez led a “Fast Flash Compliance Tips” presentation for a group of Word & Brown Elite Brokers. (If you’re not already an Elite Broker, ask your Word & Brown representative about how you could earn qualification based on your production with us.)

Below we’ve summarized some of the key points in Rene’s educational program.

1: ERISA – and Why It’s Important

ERISA, known formally as the Employee Retirement Income Security Act of 1974, is the federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry.

ERISA requires plans to provide participants with essential information about plan features and funding. It also sets minimum standards for participation, vesting, benefit accrual, and funding.

The federal law protects welfare benefit and retirement savings plans from mismanagement and abuse. It clarifies the fiduciary responsibilities for those who manage and control plan assets and requires them to act in the best interests of plan participants.

The Plan Document and Summary Plan Description promote transparency and accountability.

Plan Document

- Legal document that governs plan

- Language required by ERISA not included in the carrier’s documents

- Typically written in legalese

- Not distributed, but must be provided upon request (30 days) – or face a $110/day penalty

- No small plan exemption

- Audit tip: Department of Labor (DOL) will always ask for document in event of audit

Summary Plan Description (SPD)

- Primary method for communicating plan terms to participants

- Plain language, written summary of plan

- The SPD must be considered sufficiently accurate and comprehensive to reasonably apprise participants and beneficiaries of their plan rights and obligations

- Must be written in a manner understood by the average plan participant

- Must comply with:

- Style and format regulations

- Content regulations

- Foreign language regulations

ERISA gives participants the right to sue for benefits and breaches of fiduciary duty; and, if a defined benefit plan is terminated, guarantees payment of certain benefits through the Pension Benefit Guaranty Corporation (PBGC), a federally chartered corporation.

In general, ERISA does not cover plans established or maintained by governmental entities, churches for their employees, or plans maintained solely to comply with applicable workers compensation, unemployment, or disability laws.

2: WRAP Document

The most common and recommended approach is an ERISA WRAP. Use a WRAP to supply the terms not included in the insurer’s documentation, then incorporate the insurer’s documentation and all other essential written material. Together, the WRAP plus Explanations of Coverage and related materials constitutes the plan document or SPD.

A bookends approach to ERISA:

- Multiple benefits (e.g., Medical, Dental, Vision, etc.) may be bundled with all documentation – “wrapped” into one plan.

- Single Plan may be bundled with all documentation and “wrapped” into one document.

- May use the “wrap” method for both plan document and SPD.

Materials must satisfy ERISA content rules and regulations.

It’s important to be proactive! The employer can also use a WRAP to provide terms that will assist in the administration of the plan. That includes the specific ability to amend or terminate the plan; clarify distribution of medical loss ratio rebates; obtain more favorable standard review in the event of a lawsuit; and include terms of plan during a leave of absence.

Required employer notices are also a part of an ERISA WRAP.

3: IRS Form 5500

As you and your affected clients already know, Form 5500 is used by employers with 100 or more plan participants to comply with the annual reporting requirements under Title I and Title IV of ERISA and under the Internal Revenue Code.

The IRS Form 5500 series is an important compliance, research, and disclosure tool for the DOL, a disclosure for plan participants and beneficiaries, and a source of information used by other federal agencies.

Because larger groups can have dozens of plans, ERISA provides flexibility to employers regarding the number of SPDs:

- Different SPDs are allowed for each plan offering.

- Different SPDs are permitted for different classes of employees under the same plan.

- Different SPDs for different benefit components should also be permitted under the same plan.

- Or one document can serve as SPD for several plans: WRAP.

Is your client subject to reporting? That depends on your client’s group size, which is determined annually at the beginning of each plan year. (It can change from year to year.) Groups with 100 or more participants must comply. Certain safe harbors apply to groups with fewer than 100 participants.

4: Fast Flash Tips: ERISA

It’s critical that you be vigilant with your clients. Be sure they keep their plan documents and Summary Plan Description up to date. If your clients make plan modifications, that triggers a Summary of Material Modification to participants. Using a WRAP makes your life – and your clients’ lives – much easier.

If your clients get complex compliance questions from employees, the WRAP SPD and plan documents are a source of information on:

- Leave law policies;

- Qualifying events;

- Non-discrimination testing; and

- COBRA rights notice.

The WRAP SPD also simplifies Form 5500 filing for groups with 100 or more participants.

5: ACA Employer Mandate

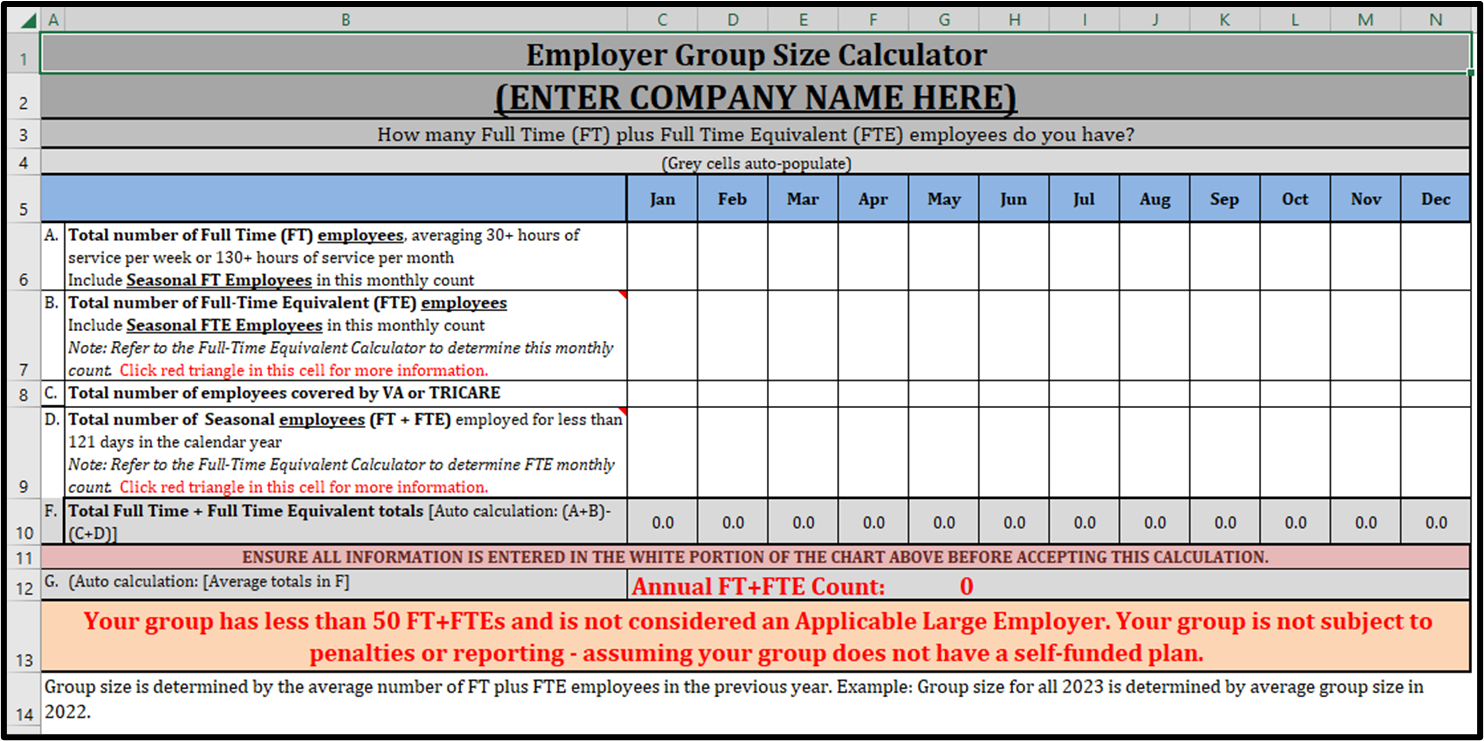

Are your clients subject to the ACA employer mandate? Do they have 50 or more full-time and Full-Time Equivalent (FTE) employees? Look at their employee count for the previous calendar year. Annually check whether they are an Applicable Large Employer (ALE) as set forth in the ACA. We suggest the numbers check happen on or near January 1st each year. Of course, if the group has an employee count well above 50 FT + FTE employees, an annual check is probably not necessary.

Fast Flash Tips: ALE + Employer Mandate

Your client may want to consider tracking group size in real time. The employer can enter the FT and FTE information monthly into a Group Size Calculator to plan ahead for ALE Status check ahead of 1/1. Visit Word & Brown’s website for a full range of ACA Calculators, including an Affordability Calculator, Employer Penalty Calculator, Full-Time Equivalent Calculator, and Group Size Calculator.

When doing calculations, it’s important to exclude seasonal employees who worked fewer than 121 days. Employees covered under the federal TRICARE or VA health programs should also be excluded.

Full-Time/Eligible Employee Check Under the ACA

The ACA defines a full-time employee as one who provides 130 hours of service a month, or 30 hours of service a week.

A Variable Hour or Seasonal employees who averages at least 130 hours of service a month across a lookback measurement period is considered a full-time employee.

Under California Labor Code, FT status determines when someone must be paid overtime. The code states that the maximum hours an hourly employee can work in a week without being paid overtime is 40 hours.

Under the California insurance code, an eligible FTE is an individual with an average work week of 30 hours.

Fast Flash Tip: Eligibility

Documentation for Full-Time eligibility needs to be clear in all plan documents. Be sure keep in mind state definitions and carrier guidelines.

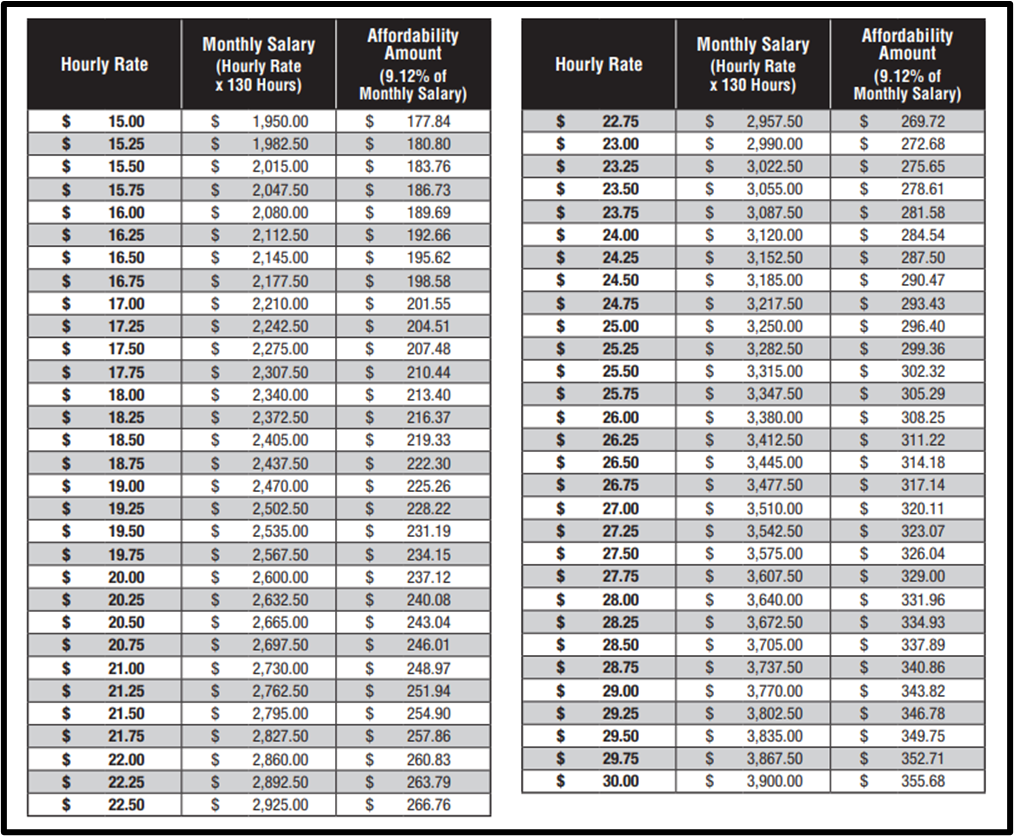

6: Affordability

When it comes to ensuring affordability for your employees’ health insurance, your client’s objective should be to ensure that each full-time employee does not pay more than 9.12% (in 2023) for health coverage. The employee’s rate of pay applies for the plan year, as does the Federal Poverty Level threshold. The amount entered in the employee’s W-2 Box 1 (Income) applies for the calendar year.

Fast Flash Tips: Affordability

The determination of whether coverage is affordable is based on the lowest-cost plan offered to employees (for the employee-only rate). This is typically a Bronze level plan.

Employers have two chances at making plan affordability adjustments during the calendar year.

Renewal/New Business

- Rate of Pay (ROP) at the time of renewal/new business

- Federal Poverty Level six months prior to start of contract

At the End of the Year

- W-2 Box 1 Safe Harbor

- May help if missed ROP affordability calculation

- Permanent extension to provide 1095C to employees

Be sure your clients check with a CPA or tax consultant on these matters.

Affordability – Federal Poverty Level (FPL) vs. Rate of Pay

Here’s a look at how using the Federal Poverty Level and Rate of Pay compare:

- FPL

- Most expensive option under Safe Harbor

- Guarantees full-time employees’ pay is less than 9.12% of the FPL (no more than $103.28/month under 2022 FPL)

- Risk of unaffordable coverage is reduced (minimal calculations; only one target number)

- ROP

- More affordable than FPL

- Guarantees full-time employees’ pay is less than 9.12% of the ROP (for employees who make more money, the burden decreases on the employer; employee affordability amount is locked in for the entire plan year – even if the employee has a reduction in hours)

- Risk of unaffordable coverage increases as compared to FPL Safe Harbor

- Complex calculations: Affordability can vary based on age and rate of pay; older employees that make a low rate of pay may be expensive to cover

- More affordable than FPL

- Most expensive option under Safe Harbor

W-2 Box 1 Safe Harbor

Application of this safe harbor is determined after the end of the calendar year – on an employee-by-employee basis. This considers the Form W-2 wages and the required employee contribution for that year.

It allows the employer to use an employee’s entire taxable wages in a calendar month: overtime, tips, and bonuses.

Rate of Pay safe harbor is capped at 130 hours of service monthly. Federal Poverty Level is based on FPL for a household of one.

Reminder: W-2 Box 1 calculation can only be determined after the conclusion of the calendar year.

Fast Flash Tips: W-2 Box 1 Safe Harbor

An individual’s affordability calculation depends on the number of months employed and benefits eligible under the group health plan. Use a formula of W-2 Box 1 wages multiplied by 9.12% with an adjustment for partial year coverage. If an employee works fewer hours that anticipated, this could impact the affordability calculation.

Employers cannot decrease their contributions outside of open enrollment to use this safe harbor. If the employer chooses to use this safe harbor, it must use the same safe harbor for all similarly situated employees.

Different safe harbors can be used for different classes listed in ACA regulations.

Again, it’s always best for employers to check with a CPA or tax consultant on these matters.

Two valuable guides are available from Word & Brown for 2023. You can order the ACA Affordability Guide and ACA Quick Reference Guide from our Insurance Forms Library.

7: MEC and MC Verification

Applicable Large Employers face potential penalties if coverage offered to employees fails to meet guidelines for Minimum Essential Coverage (MEC) and Minimum Value (MV).

Under ACA Section 4980H, the Shared Responsibility for Employers Regarding Health Coverage, Penalty “A” applies for failure to offer MEC to “substantially all” full-time employees and their dependents. Penalty “B” apples for failure to offer affordable coverage that meets MV to full-time employees.

For the 2023 tax year, the 4980H(a) penalty, sometimes referred to as the hammer penalty, is $240 or $2,880 annualized per employee. The 4980H(b) penalty is $360 a month or $4,320 annualized, per employee.

An employer cannot be assessed both a “A” and “B” penalty for the same tax year. If a business violates both ACA requirements, only the greater penalty will be assessed.

8: IRS Forms 1095

The ACA requires insurance carriers and plan sponsors of self-insured plans to report to the IRS using Form 1095-B certain information about individuals covered by MEC.

Applicable Large Employers are required to report offers of health coverage and enrollment in health coverage for employees using Form 1095-C.

Fast Flash Tip: IRS Form 1095

Download your copy of Word & Brown’s A-B-C’s of IRS Form 1095 for additional information. Choose from English, Chinese, Korean, Spanish, and Vietnamese editions.

9: COBRA

Determining whether your client’s group is subject to federal or Cal-COBRA is, again, based on a group size. Your client’s group size calculation is based on 50% or more of typical business days during the previous calendar year. The annual determination should be done early in the year – perhaps just as the year gets underway (e.g., January 1).

Federal COBRA applies to employers with more than 20 employees. Cal-COBRA applies to California employers with 2-19 employees.

Two suggested methods for the group size calculation are a day-by-day count or payroll count.

Who gets counted?

- Common-law employees

- Full-time

- Part-time

- Staffing agency

- Seasonal et. al.

Who is excluded from employee count?

- Partners in a partnership

- Individuals who are self-employed

- Independent contractors

- Directors of a corporation

Employee Check

Full-time employee: Whatever the employer considers to be full-time for overtime purposes. For example, it could be 40 hours per week, 32 hours per week, or 30 hours per week.

Part-time employee: A fraction of a full-time employee. For example, if a part-time employee works 20 hours a week, and the employer considers 40 hours a week full-time, that employee represents a half full-time employee (20/40 = 0.5 full-time employee).

COBRA Notices

Enrolled employees or dependents must receive notice of their COBRA general rights within 90 days of enrollment. A COBRA election notice is required within 14 days of a qualifying event.

Fast Flash Tips: COBRA/Cal-COBRA

Employers should monitor group size in real time to plan for the annual COBRA status determination on January 1.

Notify the employer’s carrier (or carriers) if COBRA status changes. It could result in savings for participants (premium of 110% under Cal-COBRA vs. 102% under COBRA).

Your clients should work with a COBRA third-party administrator (TPA) to determine yearly counts; it can be a complicated calculation.

Employers may want to consider embedding the COBRA general rights notice in an ERISA WRAP document distributed after enrollment. For federal COBRA, the TPA provides the notice. For Cal-COBRA, the plan carrier sends notices.

Word & Brown Compliance Resources

Word & Brown offers a variety of compliance resources for you and your clients. Use “Form Search” in our online Insurance Forms Library to find the form you want.

If you need other assistance, contact your Word & Brown representative. If you’re not already doing business with Word & Brown, it’s easy to register using our online form.