Whether you’re quoting Small Group or Large Group, Word & Brown is committed to making it easy for you. It all starts with essential group information, including:

- Company name, address, city, and ZIP Code

- Years in business

- Group headquarters (if other than address given above)

- Effective date of coverage or current renewal date (if group is already insured)

- Nature of business/SIC Code

- Employer contribution (minimum 50/50)

- 5-year carrier history (who is incumbent carrier and for how long?)

- Large claims group report, if available

- Current and renewal rates, all coverages

- Summary of Benefits for all plans offered – e.g., Medical, Dental, Vision, Life, etc.

- New hire waiting period

- Broker of Record? Yes/No

- Broker Firm, Broker Name, Address

If group is categorized as a Small Group currently but is seeking Large Group coverage, additional items are needed, including current and renewal rates/rate table; last invoice from current carrier, and DE 9C (may be requested at carrier discretion).

Your Member Level Census in Excel must include:

- Name

- Date of birth

- Gender

- Home ZIP Code for each employee

- Plan selection (HMO, PPO, EPO, HSA, etc.)

- If wrapping with Kaiser Permanente, please identify Kaiser Permanente enrollees

- Tier levels for each enrollee or three tiers (if applicable)

- COBRA participants, if any, and COBRA termination date

- Reason for waiving, if applicable (All non-valid waivers count toward participation)

Quote Delivery

Your quote from Word & Brown features the following:

- Quote details (company, quote information, quote preparation info, current and renewal information, and quoted packages and contributions)

- Census page showing rate for all plan participants and all selected Medical and Ancillary coverage

- Amount of Life Insurance

- Bundling discount summary

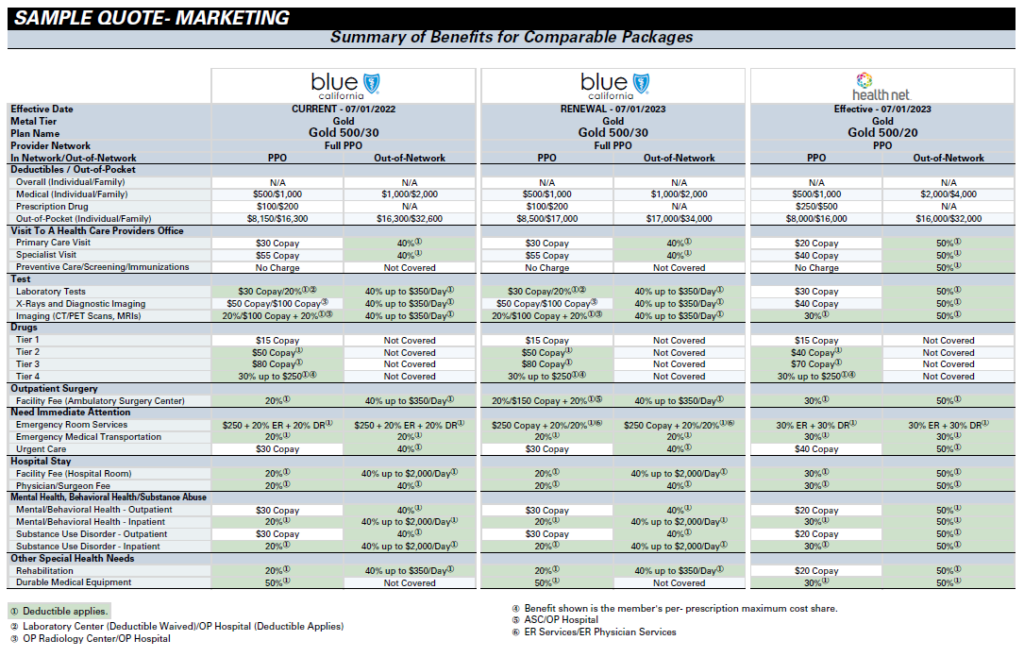

- Summary of Benefits & Rate Comparison – side-by-side view of multiple carriers with highlighted plan differences

- Detailed rate comparison with census

- Carrier- or administrator-specific Dental requirements, if requested

- Carrier- or administrator-specific Dental HMO Summary of Benefits & Rate Comparison, if requested

- Carrier- or administrator-specific Dental PPO Summary of Benefits & Rate Comparison, if requested

- Carrier- or administrator-specific Vision Benefits and Premiums summary, if requested

- Carrier- or administrator-specific Life Benefits and Cost Comparison, if requested

What to Focus On in Client Meetings

A Word & Brown quote differs from what you might get using another quoting platform. We provide you a true comparison of your client’s current plan vs. renewal options – with highlighted plan differences.

Highlighted plan differences make it easier for you and your clients to see what sets each plan apart, speeding up plan selection, and expediting your group’s enrollment.

A Word & Brown Small Group quote also includes:

- Built-in safeguards to prevent inaccurate rates

- Automated deductible and Rx updates to alert you when deductibles apply before benefits kick in

- Alerts if you pair plan packages that cannot be sold together

- Customizable output, with 30+ layout options

- Multilingual translations: choice of English, Spanish, Chinese, Korean, and Vietnamese

- Wrap quoting – a single quote when two carriers are offered together

- Quoting for Medical and Ancillary using a single platform

- Integrated provider search to ensure clients get the doctors, medical groups, and hospitals they want

- Single-page executive highlights

For Large Group quotes (101+ in CA, 51+ in NV), you can expect:

- A streamlined RFP process, with one easy-to-use census for all carriers

- Support from an experienced Large Group team with strong carrier relationships

- Strategizing on the best possible options for your clients and prospects

- RFP processing assistance and single submission to the carrier(s)

- Personalized presentation portfolios with your name and logo

- One-page executive summary

- Discovery calls with clients to uncover wants, needs, and concerns not always revealed in a conventional RFP process – helping you avoid pain points like network issues, service concerns, pharmacy benefits questions, etc.

- Customized side-by-side benefit and rate comparison

- Quote review and rate negotiation with carrier(s) once plan is selected

Login now to start your Small Group quote or download forms to begin a Large Group quote.

Everything You Need to Earn More

Word & Brown delivers everything you need to quote more, write more, and earn more. That includes enrollment tech – plus bilingual enrollers in California.

Get started now by contacting your Word & Brown rep.

If you’re not already doing business with us, we make it easy to get started. Complete our online registration form, or call us at 800-869-6989.