If you’re not already selling Vision Insurance, there are four good reasons to consider it.

- Low market penetration: In 2017, Zenefits reported that just over one-third (36%) of employers offered vision benefits to employees. Even six years later, it’s estimated that fewer than half of employers offer vision benefits. Your sales opportunities are outstanding.

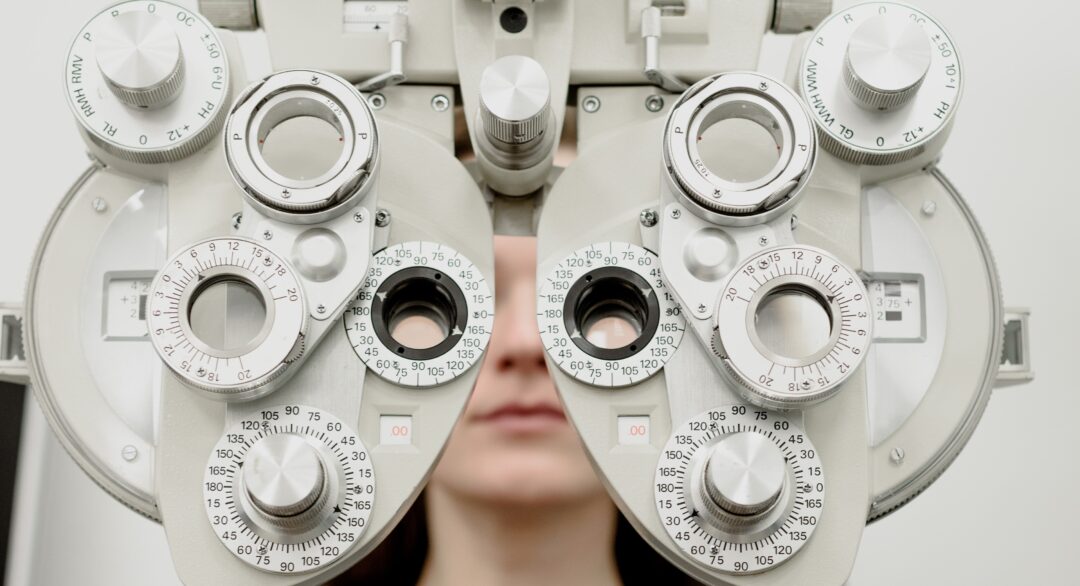

- Significant prospects: The Vision Council says nearly 70% of Americans age 18 and older need some form of vision correction (e.g., eyeglasses, contact lenses, and/or vision correction surgery).

- A “must-have benefit”: In the 2023 MetLife Employee Benefits Trends Study, 70% of employees rank Vision Insurance or a discount program for vision care as a “must-have benefit.” It ranked behind Health Insurance (79%) and Dental Insurance (73%).

- It can be worthwhile: Investopedia suggests that for who need glasses or contacts, Vision Insurance or a discount program often deliver savings. For employers, offering Vision benefits can contribute to higher employee retention.

What’s Covered

Vision Insurance is intended to help offset the costs of eye exams and prescription eyewear – generally eyeglasses and contact lenses. Some services may have a copay or may be limited in frequency. Discounted vision correction surgery may also be available through a Vision Care plan, although discounts vary by plan.

Other “enhancements” may be discounted as well, including:

- Designer frames or brand-name contacts

- Scratch-resistant coating on lenses

- Anti-glare coating on lenses

- Polycarbonate lenses

- Transition lenses that turn dark when exposed to daylight

- No-line bifocals/progressive lenses

A Roster of Choices

Word & Brown offers Vision benefits from more than two dozen carriers and administrators. That includes coverage through many of our health care partners in California and Nevada as well as Vision-only plans from EyeMed, SecureCare Vision, United Concordia Vision, Vision Plan of America, and VSP. (Carrier availability varies by state.)

In California, CaliforniaChoice offers Vision Care through Ameritas and EyeMed. The ChoiceBuilder Ancillary exchange offers Vision Insurance through EyeMed and VSP.

Visit our website for a full list of our Vision Insurance partners.

For information on the commissions you could earn selling Vision Insurance, download our state- and group size-specific compensation summaries:

- Product Portfolio & Broker Commissions – California Large Group

- Product Portfolio & Broker Commissions – California Small Group

- Product Portfolio & Broker Commissions – Nevada Large Group

- Product Portfolio & Broker Commissions – Nevada Small Group

Or you can search for carrier-specific commission info for Vision in the Insurance Forms Library.

Upcoming WBQuote Lite Enhancement

Beginning in June, you’ll be able to quote Vision plans from Humana in WBQuote Lite. More carriers will follow in the months ahead. It’s part of our continuing commitment to give you the tools you need to quote, close, and earn more. Watch for more information.

See More Earnings in Your Future

Selling Vision can help you boost your income – and your client retention. The more products you offer to clients, the more they will depend on you.

Talk with your Word & Brown rep today about Vision Insurance – and all of the Ancillary products available through our partners. If you’re not already doing business with us, it’s easy to get started; just fill out our online registration form.